When Will Pi Coin Be Tradable? Exchange Listing Rumors & Facts

Executive Summary

The Pi Network, a cryptocurrency project aiming for mass adoption, has captivated millions with its promise of free mining via a mobile app. However, the question on everyone’s mind is: when will Pi coin be tradable on major exchanges? While no official date has been announced, this article delves into the rumors, speculations, and facts surrounding Pi’s potential exchange listing, examining the factors that will influence its timeline and the implications for its future value. We’ll explore the project’s development, the mainnet launch, the KYC process, and the overall cryptocurrency market conditions, offering a comprehensive look at the road ahead for Pi Network. Understanding these factors is crucial for anyone invested in or curious about this unique cryptocurrency project.

Introduction

Pi Network has garnered significant attention as a cryptocurrency project accessible to a vast audience through its mobile mining app. Unlike many other cryptocurrencies requiring specialized hardware and technical expertise, Pi allows users to “mine” Pi coins simply by engaging with the app. This unique approach has led to a massive user base, but the crucial question remains: when will Pi become tradable on mainstream exchanges? The answer is complex and depends on several factors discussed in this detailed analysis. This article will explore the timeline, the challenges, and the potential implications of Pi’s eventual listing, providing a clear picture of what to expect.

FAQ

-

Q: When will Pi be listed on exchanges? A: There is no official date. Pi Network’s timeline depends on completing key milestones, including the successful mainnet launch and KYC verification for a significant portion of its user base.

-

Q: Is Pi Network a scam? A: Whether Pi Network is a scam is a matter of ongoing debate. While its innovative approach to mining and accessibility is appealing, its lack of immediate tradability and the uncertainty surrounding its future value raise concerns among some. Thorough research and a cautious approach are advised.

-

Q: How can I get Pi coins now? A: You can download the Pi Network app and participate in their mining process. However, keep in mind that these coins are not currently tradable, so they hold no monetary value until they are listed on an exchange.

Pi Network Mainnet Launch

The successful launch of Pi Network’s mainnet is a crucial prerequisite for exchange listings. The mainnet signifies the transition from a test network to a fully functional blockchain, enabling transactions and facilitating the transfer of Pi coins. Until the mainnet is stable and fully operational, exchange listing is unlikely.

-

Mainnet Functionality: A fully functional mainnet is essential for handling the large volume of transactions expected once Pi is tradable. Any instability or scalability issues could delay listing.

-

Security Audits: Before a mainnet launch, rigorous security audits are necessary to identify and address any vulnerabilities that could expose the network to attacks.

-

Node Deployment: A robust network of nodes is required to support the mainnet and ensure its decentralized operation. The more nodes participating, the stronger and more reliable the network becomes.

-

Ecosystem Development: A thriving ecosystem with decentralized applications (dApps) and other utilities built on the Pi Network will increase its value and attractiveness to exchanges.

-

Community Growth: Continued growth and engagement of the Pi Network community are key indicators of its long-term viability and potential for success. A strong community fosters trust and adoption.

KYC (Know Your Customer) Verification

KYC verification is a critical process that plays a significant role in Pi Network’s journey to exchange listings. KYC involves verifying the identity of users to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations.

-

KYC Completion Rate: A higher KYC completion rate among Pi users will significantly boost confidence among exchanges considering listing Pi. A large number of unverified accounts could deter potential exchange partners.

-

Regulatory Compliance: Meeting KYC requirements is essential for compliance with global regulations and gaining the trust of financial institutions.

-

Security Enhancement: KYC processes strengthen the security of the Pi Network by reducing the risk of fraudulent accounts and malicious activities.

-

User Experience: A smooth and user-friendly KYC process is crucial to ensure high participation and minimize frustration among users.

-

Verification Methods: The reliability and efficiency of the chosen KYC methods will influence the speed and success of the verification process.

Exchange Partnerships

Securing partnerships with reputable cryptocurrency exchanges is the final, but perhaps most challenging step towards Pi’s tradability. Exchanges carefully vet projects before listing them, considering factors like security, community, and potential market demand.

-

Exchange Selection: Pi Network needs to select exchanges that align with its vision and target audience. Partnering with well-established, trusted exchanges increases legitimacy and accessibility.

-

Listing Fees: Negotiating favorable listing fees with exchanges is crucial. These fees can significantly impact the profitability and sustainability of the Pi Network project.

-

Market Demand: The level of market demand for Pi will influence exchange interest in listing the coin. A strong community and high user anticipation increase the likelihood of a successful listing.

-

Technological Integration: Seamless integration of Pi Network’s blockchain with the chosen exchange’s platform is essential for smooth and efficient trading.

-

Marketing & Promotion: Joint marketing and promotional activities with exchanges can increase awareness and adoption of Pi.

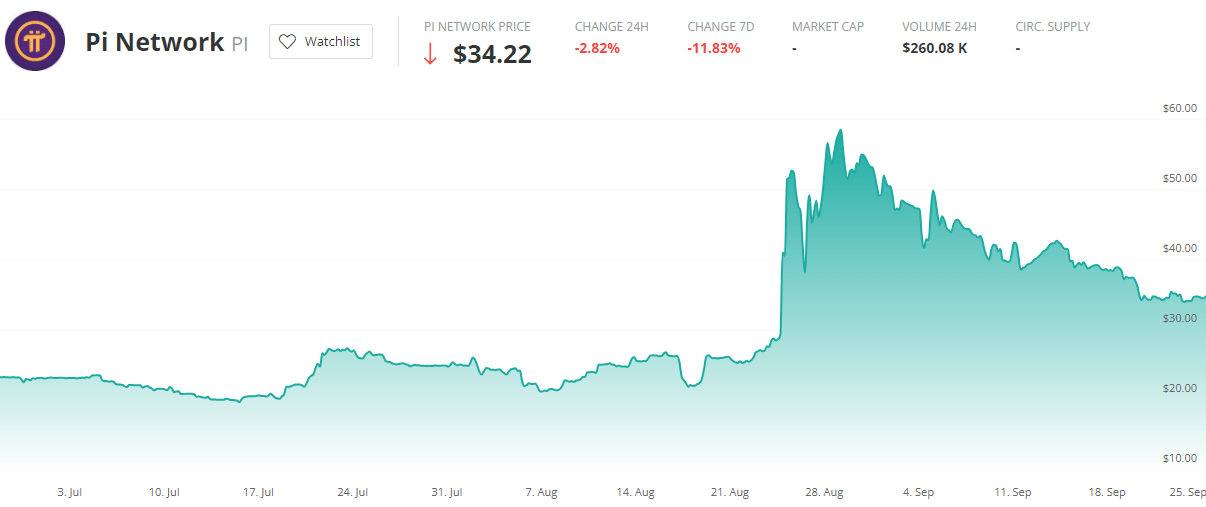

Cryptocurrency Market Conditions

The overall state of the cryptocurrency market is another unpredictable factor influencing Pi Network’s exchange listing. Market volatility and investor sentiment play a significant role in determining which projects receive attention and investment.

-

Market Sentiment: Positive market sentiment towards cryptocurrencies in general can increase the likelihood of Pi’s successful listing and initial trading performance.

-

Regulatory Landscape: Favorable regulatory developments in the cryptocurrency space can boost investor confidence and create a more conducive environment for new projects to launch.

-

Bitcoin’s Price: Bitcoin’s price often affects the overall performance of the crypto market, influencing investor decisions and potentially impacting Pi’s trajectory.

-

Competition: Competition from other cryptocurrency projects will also affect Pi’s success in attracting exchange listings and investors.

Conclusion

The question of when Pi coin will be tradable remains unanswered, hinging on several interconnected factors. While the project has shown impressive growth in its user base, achieving mainnet launch, successfully implementing KYC verification, securing exchange partnerships, and navigating the ever-changing cryptocurrency market present significant challenges. While there’s considerable enthusiasm, a realistic and cautious approach is needed. Remember, the value of Pi coins is currently speculative, and the project’s ultimate success depends on the fulfillment of these essential milestones. The journey is long and full of uncertainties, but the potential rewards make it a captivating project to follow.

Keyword Tags:

Pi Network, Pi Coin, Cryptocurrency Exchange Listing, Mainnet Launch, KYC Verification